Assume that Nathan County has levied its current year taxes and all revenue recognition criteria for property

Question:

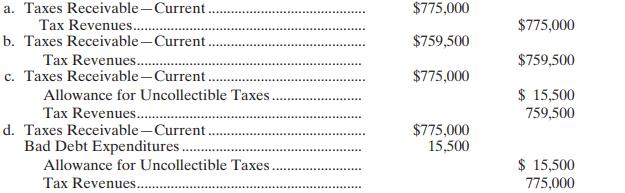

Assume that Nathan County has levied its current year taxes and all revenue recognition criteria for property taxes have been met. The amount levied was $775,000, of which 2% is deemed to be uncollectible (based on historical experience). Which of the following entries would be made in the General Fund?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Governmental And Nonprofit Accounting

ISBN: 9781292040080

10th International Edition

Authors: Robert J. Freeman, Craig D. Shoulders, Gregory S. Allison, G. Robert Smith

Question Posted: