Choose the best answer. 1. GASB standards require a statement of cash flows for a. Internal service

Question:

Choose the best answer.

1. GASB standards require a statement of cash flows for

a. Internal service funds.

b. Enterprise funds.

c. All internal service funds and enterprise funds.

d. Only internal service funds and enterprise funds that are reported as major funds.

2. Which of the following would most likely be accounted for in an internal service fund?

a. The city pool.

b. An asphalt plant used to supply the asphalt needed to resurface the city’s streets.

c. The city’s investments, which are pooled with the county’s and the school district’s investments.

d. Proceeds from an endowment that are used to maintain the city’s library.

3. Under GASB standards, the City of Parkview is required to use an enterprise fund to account for its nature center if

a. It charges fees to assist in paying for the maintenance of the nature center.

b. The nature center was originally financed through the issuance of general obligation bonds.

c. The ordinance that was passed to establish the nature center requires that all costs of the nature center be paid for by user fees.

d. All of the above are true.

4. During the current fiscal year, the Palm Springs government recorded a $25,000 transfer from the General Fund to an internal service fund, a $25,000 transfer from the General Fund to an enterprise fund, a $5,000 transfer from an enterprise fund to an internal service fund, and a $15,000 transfer from an enterprise fund to the General Fund. In the Business-type Activities column of the government-wide financial statements, Palm Springs should report

a. Net transfers out of $10,000.

b. Net transfers in of $5,000.

c. Net transfers out of $15,000.

d. Net transfers in of $30,000.

5. Which of the following events would generally be classified as nonoperating on an enterprise fund’s statement of revenues, expenses, and changes in fund net position?

a. Loss on the sale of a piece of equipment.

b. Billing other funds of the same government for services.

c. Depreciation expense.

d. Administrative expense.

6. A proprietary fund issued $5,000,000 of bonds at par to purchase new machinery. If the machinery has not been purchased by year-end, the bond proceeds are reported on the statement of net position as

a. A decrease in Net position—net investment in capital assets.

b. An increase in Net position—net investment in capital assets.

c. Restricted net position.

d. Committed net position.

7. Under GASB standards, which of the following events would be classified as an investing activity on a proprietary fund’s statement of cash flows?

a. Interest earned on certificates of deposit held by the proprietary fund.

b. Purchase of equipment for use by the proprietary fund.

c. Grant received to construct a building that will be used by the proprietary fund.

d. All of the above would be considered investing activities for reporting purposes.

8. If a predominant portion of an internal service fund’s operating income results from billings to enterprise funds,

a. The internal service fund should be converted to an enterprise fund.

b. The government should report the internal service fund’s residual assets and liabilities within the Business-type Activities column in the statement of net position.

c. The government should present the internal service fund as a major fund in a separate column of the proprietary fund statements.

d. The internal service fund should be combined with other governmental funds in the Governmental Activities column in the statement of net position.

9. During the year an enterprise fund purchased $230,000 worth of equipment. The equipment was acquired with a cash down payment of $30,000 and a $200,000 loan. A partial year of depreciation on the equipment was taken in the amount of $23,000. What is the net effect of this transaction on the net position accounts of the enterprise fund?

a. Net investment in capital assets is increased by $7,000.

b. Net investment in capital assets is increased by $30,000.

c. Net investment in capital assets is increased by $207,000.

d. Net investment in capital assets is increased by $230,000.

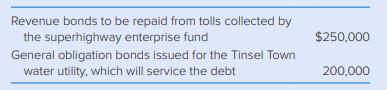

10. Tinsel Town had the following long-term liabilities at year-end:

What amount should be recorded as long-term liabilities in the proprietary fund financial statements?

a. $0.

b. $200,000.

c. $250,000.

d. $450,000.

11. The City of Tutland issued $10 million, 6 percent, 10-year bonds at 101 to finance refurbishment of its water utility fund equipment. The bond issuance is recorded in the water utility enterprise fund as

a. Other financing sources of $10.1 million.

b. Revenues of $10.1 million.

c. Bonds payable of $10.1 million.

d. Bonds payable of $10 million and premium on bonds payable of $100,000.

12. The City of Tutland issued $10 million, 6 percent, 10-year bonds at 101 to finance refurbishment of its water utility fund equipment. The bond issuance is reported in the water utility enterprise fund statement of cash flows as

a. A cash flow from operating activities.

b. A cash flow from noncapital financing activities.

c. A cash flow from capital and related financing activities.

d. A cash flow from investing activities.

Step by Step Answer:

Accounting For Governmental And Nonprofit Entities

ISBN: 9781260118858

19th Edition

Authors: Jacqueline Reck, Suzanne Lowensohn, Daniel Neely