(Modified Accrual Basis vs. Accrual Basis) On February 1, 20X3, Mobiline County acquired the following assets of...

Question:

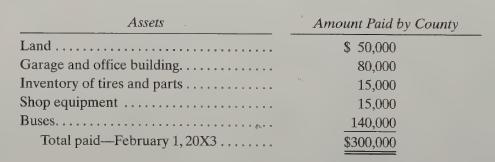

(Modified Accrual Basis vs. Accrual Basis) On February 1, 20X3, Mobiline County acquired the following assets of Mobiline Transit, Inc., a privately owned bus line in financial difficulty, with the intent of establishing a county bus service for its residents:

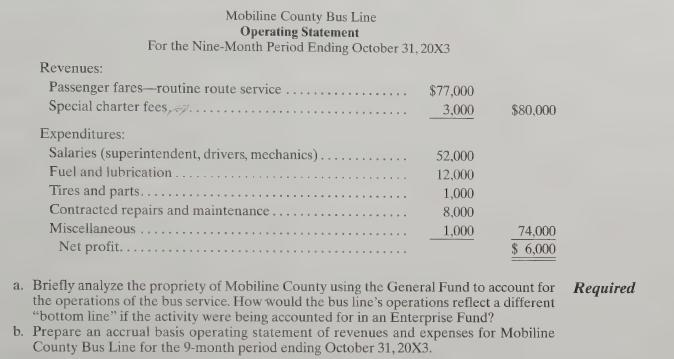

1. The purchase was financed through the issue of 6% general obligation notes payable, scheduled to mature in amounts of $30,000 each February 1 for 10 years. Interest is payable annually each February 1. 2. Bus line revenues and expenditures are initially being accounted for through the General Fund. The capital assets acquired and the notes payable were recorded in the General Capital Assets and General Long-Term Liabilities accounts. 3. The buses had remaining useful lives of 5 years and the buildings and shop equipment had remaining useful lives of 10 years when acquired. 4. As of its fiscal year-end (October 31, 20X3), the County had $3,000 of tires and parts on hand. Also, as of October 31, 20X3, the County was owed $1,000 by a local nonprofit agency for a special charter that was provided on October 20, 20X3.

5. The county's finance officer attempted to prepare an operating statement for the bus line's operations as of October 31, 20X3, using the information accounted for within the General Fund, as follows:

Step by Step Answer:

Governmental And Nonprofit Accounting Theory And Practice

ISBN: 9780132552721

9th Edition

Authors: Robert J Freeman, Craig D Shoulders, Gregory S Allison, Terry K Patton, Robert Smith,