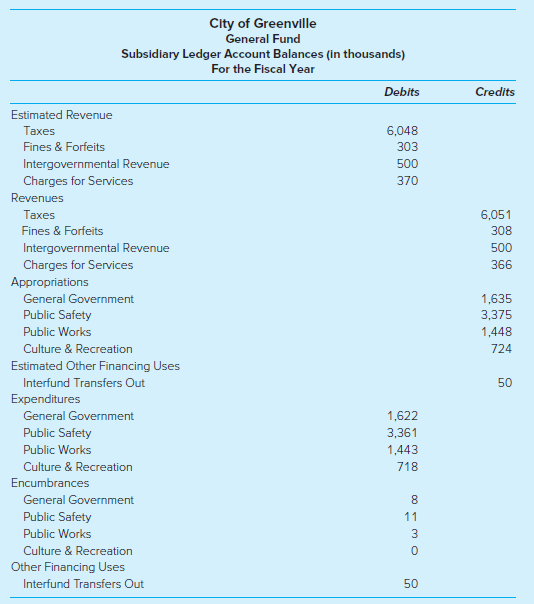

Greenville has provided the following information from its General Fund Revenues and Appropriations/ Expenditure/Encumbrances subsidiary ledgers for

Question:

Required

a. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance.

b. Prepare a General Fund schedule of revenues, expenditures, and changes in fund balance€”budget and actual (assume the budget is prepared on a GAAP basis).

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely

Question Posted: