Johnson and Bates run a small business and are worried about their accounts receivable spiralling out of

Question:

Johnson and Bates run a small business and are worried about their accounts receivable spiralling out of control.

a Advise them of the steps they can take to manage credit and recover outstanding accounts.

They are thinking about which method to calculate an amount for debts that might become bad. They are considering two methods:

i percentage of credit sales @ 1% of credit sales annually ii ageing of debtors.

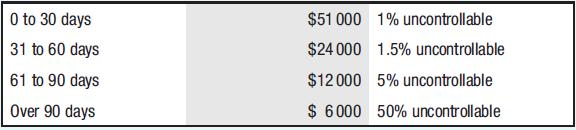

Suppose their credit sales average $235 000 for a six-month period, and they have accounts receivable of $93 000 at present, with days outstanding and expected uncollectable rates being as follows:

b What method would you recommend they choose to calculate uncollectable debts and why?

c What would be the difference between the amount recorded in the balance sheet for accounts receivable for each method?

Step by Step Answer:

Accounting Information For Business Decisions Accounting

ISBN: 9780170446242

4th Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh