The bookkeeper for Jiffy Couriers was confused when he prepared the following financial statements. N. Russell asks

Question:

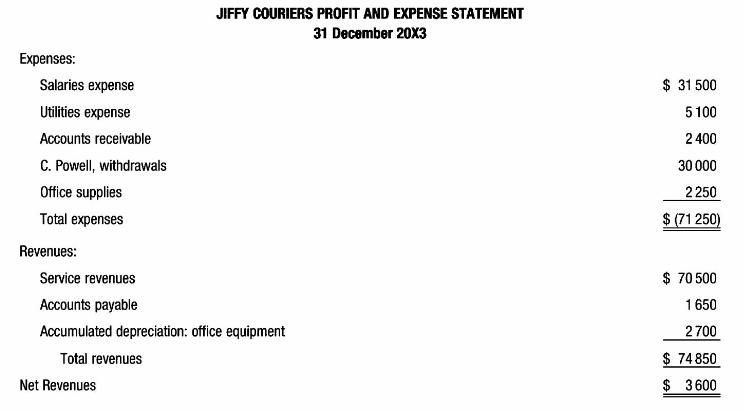

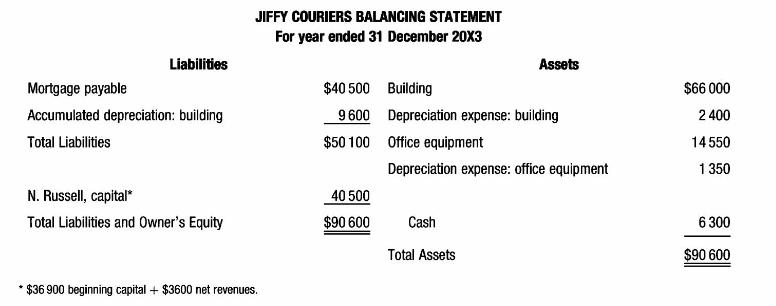

The bookkeeper for Jiffy Couriers was confused when he prepared the following financial statements.

N. Russell asks for your help. He says, 'Something is not right! My business had a fantastic year in 20X3; I'm sure it made more than \(\$ 3600\). I don't remember much about accounting, but I do recall that 'accumulated depreciation' should be subtracted from the cost of an asset to determine its book value'. You agree based on your understanding of the depreciation discussion in Chapter 4 of this book. After examining the financial statements and related accounting records, you find that, with the exception of office supplies, the amount of each item is correct even though the item might be incorrectly listed in the financial statements. You determine that the office supplies used during the year amount to \(\$ 1200\) and that the office supplies on hand at the end of the year amount to \(\$ 1050\).

Required:

a Review each financial statement and indicate any errors you find.

b Prepare a corrected 20X3 income statement, statement of changes in owner's equity and ending balance sheet.

c Calculate the profit margin for \(20 \mathrm{X} 3\) to verify or refute Mr Russell's claim that his business had a fantastic year.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons