The Foster Tax Services Company was established on 2 January of the current year to help clients

Question:

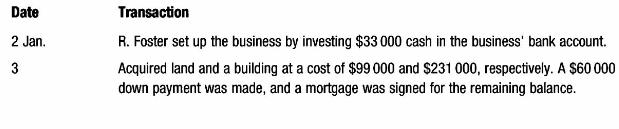

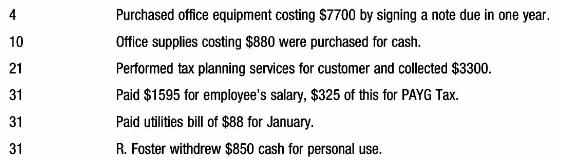

The Foster Tax Services Company was established on 2 January of the current year to help clients with tax planning and preparation of their tax returns. The business engaged in the following transactions during January:

Required:

a Set up the following T-accounts (and account numbers): Cash (101), Office Supplies (105), GST Paid (108), Land (110), Building (112), Office Equipment (115), Notes Payable (220), PAYG Tax Payable (231), GST Collected (232), Mortgage Payable (221), R. Foster, Capital (301), R. Foster, Drawings (302), Tax Service Revenues (401), Salary Expense (501), Utilities Expense (502) and Supplies Expense (503).

b Prepare journal entries to record the preceding transactions.

c Post the journal entries to the accounts.

d Prepare a trial balance at 31 January.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons