Question: You are required to prepare a cash flow statement for Fistard Neash plc for the year ended 31 December Year 6 During the year ending

You are required to prepare a cash flow statement for Fistard Neash plc for the year ended 31 December Year 6

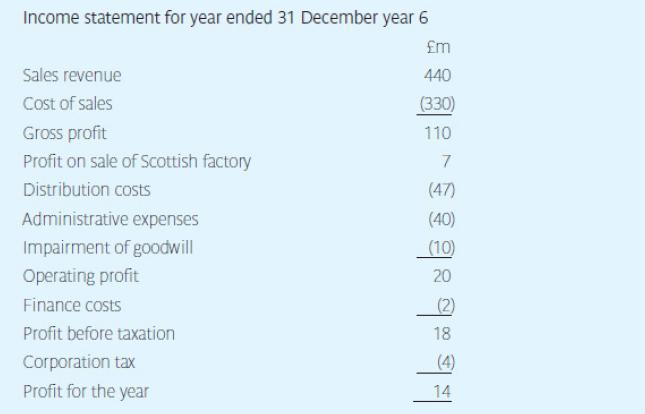

During the year ending 31 December year 6 a The Scottish factory had originally cost £24m, and depreciation of £8m had been charged on it. It was sold for £23m.

b Dividends paid were £8m.

c Interest of £2m and taxation of £4m were paid.

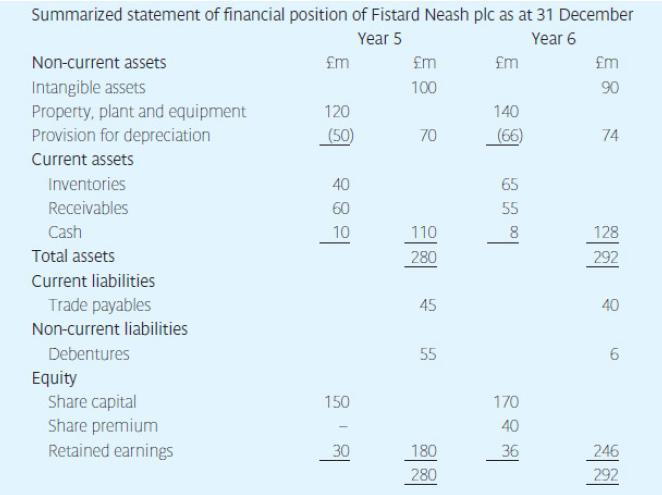

Summarized statement of financial position of Fistard Neash plc as at 31 December Year 5 Year 6 Non-current assets m m m m Intangible assets 100 90 Property, plant and equipment 120 Provision for depreciation (50) 70 70 Current assets Inventories Receivables Cash Total assets 40 60 10 110 280 140 (66) 74 74 55 8 128 292 Current liabilities Trade payables Non-current liabilities Debentures Equity Share capital Share premium Retained earnings 45 45 55 40 6 150 170 40 ' 30 180 36 246 280 292

Step by Step Solution

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts