Nina has been asked to assess the financial viability of a contract to supply the British football

Question:

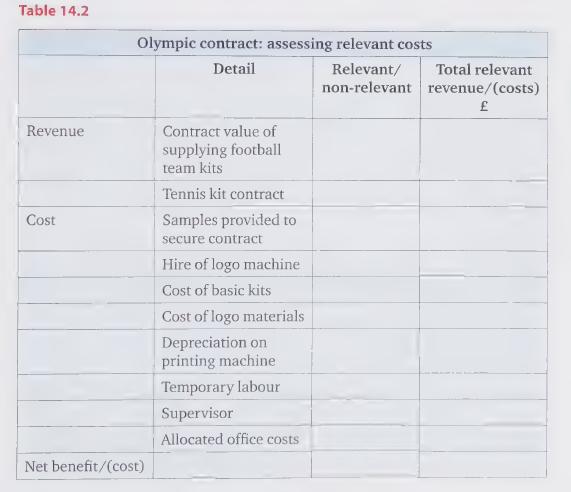

Nina has been asked to assess the financial viability of a contract to supply the British football team with 20 sets of kit for the Olympic games, which would generate £75,000 of sales revenue. She has already had preliminary discussions with the Olympic committee and had to provide football kit samples at a cost of £2,400. Nina would buy-in each basic kit for £1,575 but print and add logos for the Olympic team, using materials costing £50 per kit. Her production supervisor, Anna, would have to take on temporary labour, costing £15,700 to meet the extra demand. She would dedicate one existing supervisor, who is currently underutilized, to oversee the project and whose salary for the period is £17,500. To cope with the specific logo designs, they would need to hire special equipment at a cost of £3,400. They could use their existing printing machine for much of the work at a depreciation charge of £2,700. Anna has also warned that they would have to turn down a tennis kit contract with an expected contribution of £15,200 should they accept the Olympic one. There would be an allocated charge to cover office costs of £3,200 on the Olympic contract. Using Table 14.2, assess which revenues and costs are relevant to the decision. Then compare the relevant costs to the relevant revenues to assess its financial feasibility. Should Smart Sports go ahead with the Olympic contract?

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles