Sam has been invited by a prospective supplier of shuttlecocks to visit his factory in Greece. Vas,

Question:

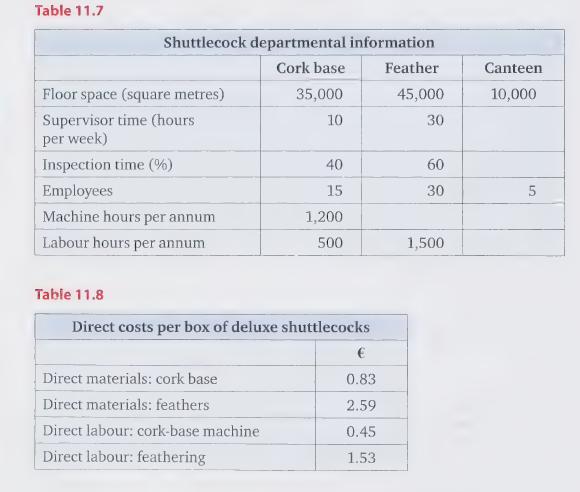

Sam has been invited by a prospective supplier of shuttlecocks to visit his factory in Greece. Vas, the factory owner, has two manufacturing departments: first the cork-base department manufactures the bases by machine, and then the feather department manually applies feathers into the cork base. A canteen supports the two manufacturing departments. As Sam is surprised at the price of a box of 10 deluxe shuttlecocks, Vas gives him some information about the raw material and direct labour costs. He tells Sam that his overheads include rent of €45,000, insurance of €9,000, a supervisor of €40,000, and inspection costs of €8,000. He also charges depreciation of €45,000 to the cork- base department, €12,000 to the feather department, and €5,000 to the canteen. Use this information and Tables 11.7 and 11.8 to calculate the cost of a box of deluxe shuttlecocks:

a) Allocate, apportion, and re-allocate costs to the two manufacturing departments: cork-base manufacture and feather application.

b) Calculate an appropriate departmental rate for each department.

c) Using the direct cost information, calculate the cost of a box of deluxe shuttlecocks, assuming that 100 boxes can be made per hour in the cork-base department and 25 per hour in the feather department.

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles