Smart Sports purchased a printing machine for 5,500, and having done some research, Sam estimates that it

Question:

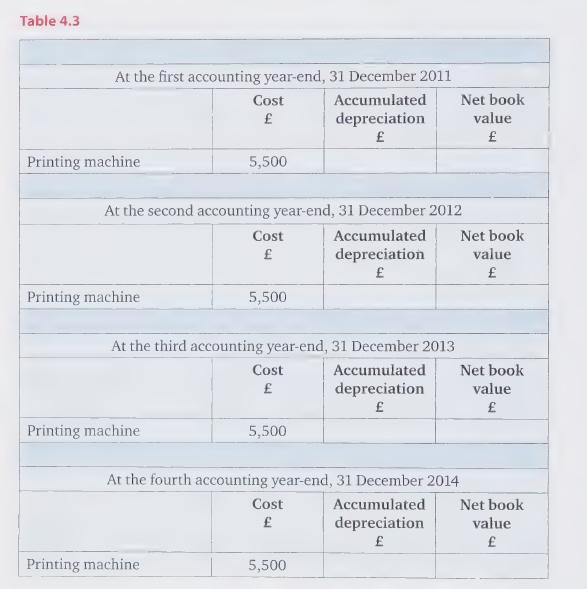

Smart Sports purchased a printing machine for £5,500, and having done some research, Sam estimates that it should have a useful life of four years, at the end of which time it is likely to have no residual value. If the straight-line depreciation method is going to be used:

a) What rate, given as percentage, should depreciation be charged at, if the machinery is to be written off over four years?

b) What will be the annual depreciation charge?

c) Knowing that the NBV of the machinery is the cost less the accumulated depreciation charged on it, calculate the NBV of the machinery at 31 December 2011 and at subsequent year ends, using Table 4.3.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles

Question Posted: