On April l0, 2014, fire damaged the office and warehouse of Corvet Company Most of the accounting

Question:

On April l0, 2014, fire damaged the office and warehouse of Corvet Company Most of the accounting records were destroyed, but the following account balances were determined as of March 31, 2014: Inventory (January 1, 2014), $80,000; Sales Revenue January 1—March 31, 2014), $180,000; Purchases (January 1—March 31, 2014), S94,000.

The company’s fiscal year ends on December 31. It uses a periodic inventory system.

From an analysis of the April bank statement, you discover cancelled checks of $4,200 for cash purchases during the period April 1—10. Deposits during the same period totaled $18,500. Of that amount, 60% were collections on accounts receivable, and the balance was cash sales.

Correspondence with the company’s principal suppliers revealed $12,400 of purchases on account from April 1 to April 10. Of that amount, $1,600 was for merchandise in transit on April 10 that was shipped FOB destination.

Correspondence with the company’s principal customers produced acknowledgments of credit

sales totaling $37,000 from April 1 to April 10. It was estimated that $5,600 of credit sales will never be acknowledged or recovered from customers.

Corvet Company reached an agreement with the insurance company that its fire-loss claim

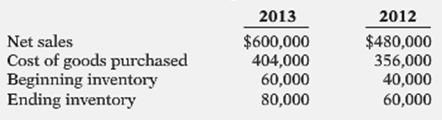

should be based on the average of the gross profit rates for the preceding 2 years. The financial statements for 2012 and 2013 showed the following data.

Inventory with a cost of $17,000 was salvaged from the fire.

Instructions

With the class divided into groups, answer the following.

(a) Determine the balances in (1) Sales Revenue and (2) Purchases at April 10.

(b) Determine the average gross profit rate for the years 2012 and 2013.

(c) Determine the inventory loss as a result of the fire, using the gross profit method.

Step by Step Answer:

Accounting Principles

ISBN: 9781118566671

11th Edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso