Natalie had a very busy December. At the end of the month, after journalizing and posting the

Question:

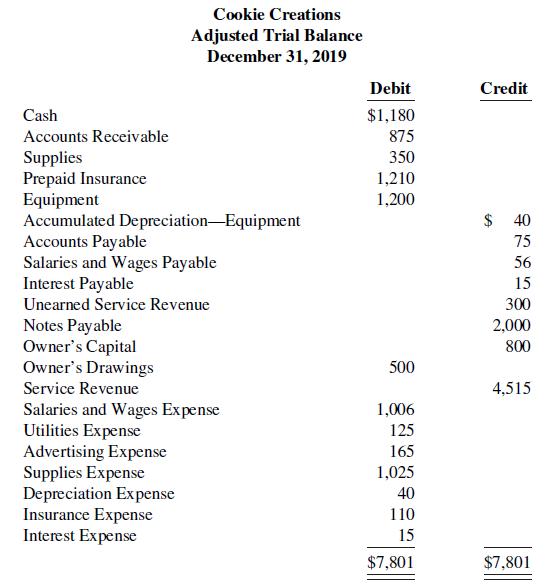

Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance.

Instructions

Using the information in the adjusted trial balance, do the following.

a. Prepare an income statement and an owner’s equity statement for the 2 months ended December 31, 2019, and a classified balance sheet at December 31, 2019. The note payable has a stated interest rate of 6%, and the principal and interest are due on November 16, 2021.

b. Natalie has decided that her year-end will be December 31, 2019. Prepare and post closing entries as of December 31, 2019.

c. Prepare a post-closing trial balance.

Step by Step Answer:

Accounting Principles

ISBN: 978-1119411482

13th edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso