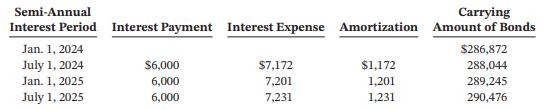

Question: A partial bond amortization schedule for GreenLeaf Corp. is provided below. GreenLeaf has a December 31 year end. a. Was the bond issued at a

A partial bond amortization schedule for GreenLeaf Corp. is provided below. GreenLeaf has a December 31 year end.

a. Was the bond issued at a premium or discount?

b. Record the interest payment on July 1, 2024.

c. Record the adjusting entry on December 31, 2024.

d. Record the interest payment on January 1, 2025.

Semi-Annual Carrying Interest Period Interest Payment Interest Expense Amortization Amount of Bonds Jan. 1, 2024 July 1, 2024 Jan. 1, 2025 July 1, 2025 $6,000 6,000 6,000 $7,172 7,201 7,231 $1,172 1,201 1,231 $286,872 288,044 289,245 290,476

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

a The bond was issued at a discount The ... View full answer

Get step-by-step solutions from verified subject matter experts