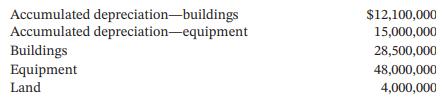

At January 1, 2024, Jaina Company, a public company, reported the following property, plant, and equipment accounts:

Question:

At January 1, 2024, Jaina Company, a public company, reported the following property, plant, and equipment accounts:

a. Jaina uses straight-line depreciation for buildings and equipment, and its fiscal year end is December 31. The buildings are estimated to have a 50-year life and no residual value; the equipment is estimated to have a 10-year useful life and no residual value. The notes mature on the anniversary date of the issue. Interest on all notes is payable or collectible on the maturity date.

During 2024, the following selected transactions occurred:

Apr. 1 Purchased land for $1.9 million. Paid $475,000 cash and issued a 10-year, 6% note for the balance.

May 1 Sold equipment that cost $750,000 when purchased on January 1, 2017. The equipment was sold for $350,000 cash.

June 1 Sold land purchased on June 1, 2003, for $1.2 million. Received $380,000 cash and accepted a 6% note for the balance. The land cost $300,000.

July 1 Purchased equipment for $1 million on account, terms n/60.

Dec. 31 Retired equipment that cost $470,000 when purchased on December 31, 2017.

Instructions

a. Record the above transactions.

b. Record any adjusting entries required at December 31, 2024, and update account balances.

c. Prepare the property, plant, and equipment section of Jaina’s balance sheet at December 31, 2024.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak