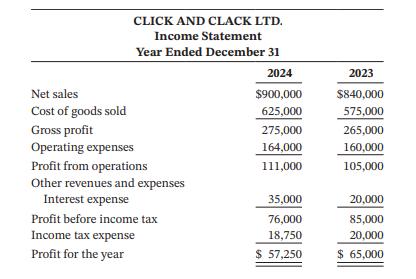

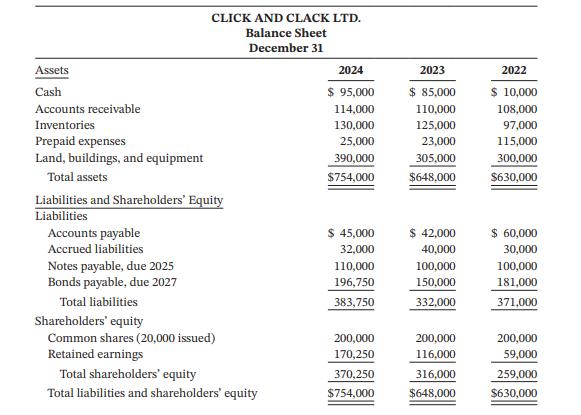

Question: Comparative financial statements for Click and Clack Ltd. are shown below. Additional information: 1. Seventy-five percent of the sales were on account. 2. The allowance

Comparative financial statements for Click and Clack Ltd. are shown below.

Additional information:

1. Seventy-five percent of the sales were on account.

2. The allowance for doubtful accounts was $4,000 in 2024, $5,000 in 2023, and $3,000 in 2022.

3. In 2024 and 2023, dividends of $3,000 and $8,000, respectively, were paid to the common shareholders.

4. Cash provided by operating activities was $103,500 in 2024 and $129,000 in 2023.

5. Cash used by investing activities was $115,500 in 2024 and $35,000 in 2023.

Instructions

a. Calculate all possible liquidity, solvency, and profitability ratios for 2024 and 2023.

b. Identify whether the change in each ratio from 2023 to 2024 calculated in part (a) was favourable (F), unfavourable (U), or no change (NC).

c. Explain whether overall

(1) Liquidity,

(2) Solvency

(3) Profitability

improved, deteriorated, or remained the same between 2023 and 2024.

Does this problem employ an intracompany comparison or an intercompany comparison? Which do you think is more useful?

CLICK AND CLACK LTD. Income Statement Year Ended December 31 2024 $900,000 625,000 Net sales Cost of goods sold Gross profit Operating expenses Profit from operations Other revenues and expenses Interest expense Profit before income tax Income tax expense Profit for the year 275,000 164,000 111,000 35,000 76,000 18,750 $ 57,250 2023 $840,000 575,000 265,000 160,000 105,000 20,000 85,000 20,000 $ 65,000

Step by Step Solution

3.46 Rating (175 Votes )

There are 3 Steps involved in it

a b c 1 Liquidity Stayed essentially the same The overall liquidity of Click and Clack is slightly b... View full answer

Get step-by-step solutions from verified subject matter experts