Glans Company purchased equipment on account on April 6, 2022, at an invoice price of $442,000. On

Question:

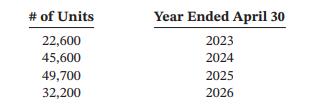

Glans Company purchased equipment on account on April 6, 2022, at an invoice price of $442,000. On April 7, 2022, it paid $4,000 for delivery of the equipment. A one-year, $3,000 insurance policy on the equipment was purchased on April 9, 2022. On April 22, 2022, Glans paid $6,000 for installation and testing of the equipment. The equipment was ready for use on May 1, 2022. Glans estimates that the equipment’s useful life will be four years, with a residual value of $20,000. It also estimates that, in terms of activity, the equipment’s useful life will be 150,000 units. Glans has an April 30 fiscal year end. Assume that actual usage is as follows:

Instructions

a. Determine the cost of the equipment.

b. Prepare depreciation schedules for the life of the asset under the following depreciation methods:

1. Straight-line

2. Double diminishing-balance, assuming a rate of 50% 3. units-of-production

c. Which method would result in the highest profit for the year ended April 30, 2024? Over the life of the asset?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak