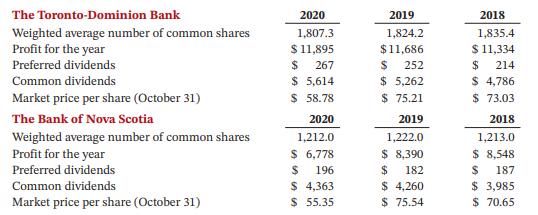

The following financial information (in millions except for per share amounts) is for two major corporations for

Question:

The following financial information (in millions except for per share amounts) is for two major corporations for the three fiscal years ended October 31 as follows:

Instructions

a. Calculate the earnings per share, price-earnings ratio, and payout ratio for the common shareholders in each company for each of the three years. Comment on whether their ratios have improved or deteriorated.

b. Compare The Toronto-Dominion Bank’s ratios with The Bank of Nova Scotia’s.

Why is the presentation of fully diluted earnings per share required under IFRS, given that it is a hypothetical number?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted: