Separate company and consolidated financial statements for Pop Corporation and its only subsidiary, Son Corporation, for 2017

Question:

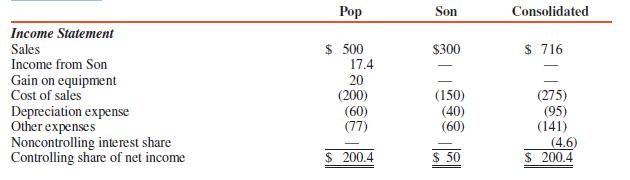

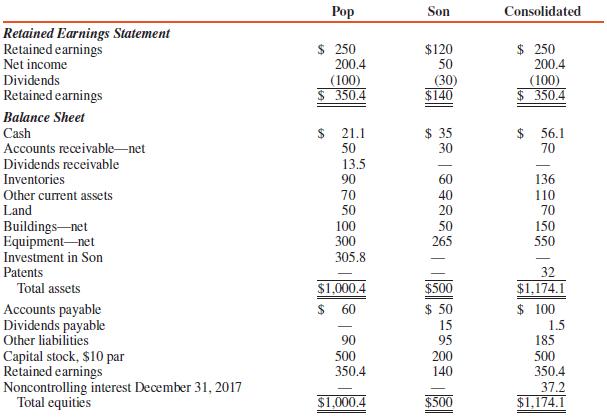

Separate company and consolidated financial statements for Pop Corporation and its only subsidiary, Son Corporation, for 2017 are summarized here. Pop acquired its interest in Son on January 1, 2016, at a price in excess of book value, which was due to an unrecorded patent.

POP CORPORATION AND SUBSIDIARY SEPARATE COMPANY AND CONSOLIDATED FINANCIAL STATEMENTS AT AND FOR THE YEAR ENDED DECEMBER 31, 2017 (IN THOUSANDS)

REQUIRED: Answer the following questions about the financial statements of Pop and Son.

1. What is Pop’s percentage interest in Son Corporation? Provide a computation to explain your answer.

2. Does Pop use a one-line consolidation in accounting for its investment in Son? Explain your answer.

3. Were there intercompany sales between Pop and Son in 2017? If so, show computations.

4. Are there unrealized inventory profits on December 31, 2017? If so, show computations.

5. Provide computations to explain the difference between the combined separate cost of sales and consolidated cost of sales.

6. Explain the difference between combined separate and the consolidated “equipment—net” line item by reconstructing the workpaper entry(s) that was (were) apparently made.

7. Are there intercompany receivables and payables? If so, identify them and state the amounts.

8. Beginning with the noncontrolling interest at January 1, 2017, provide calculations of the $37,200 noncontrolling interest at December 31, 2017.

9. What was the amount of patents at December 31, 2016? Show computations.

10. Provide computations to explain the $305,800 Investment in Son account balance on December 31, 2017.

Step by Step Answer:

Advanced Accounting

ISBN: 978-0134472140

13th edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith