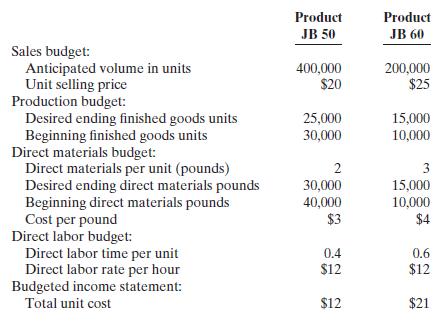

Question: Tranh Inc. is preparing its annual budgets for the year ending December 31, 2013. Accounting assistants furnish the data shown below. An accounting assistant has

Tranh Inc. is preparing its annual budgets for the year ending December 31, 2013. Accounting assistants furnish the data shown below.

An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $660,000 for product JB 50 and $360,000 for product JB 60, and administrative expenses of $540,000 for product JB 50 and $340,000 for product JB 60. Income taxes are expected to be 30%.

Instructions

Prepare the following budgets for the year. Show data for each product. You do not need to prepare quarterly budgets.

(a) Sales (d) Direct labor

(b) Production (e) Income statement (Note: Income taxes are

(c) Direct materials not allocated to the products.)

Step by Step Solution

3.23 Rating (172 Votes )

There are 3 Steps involved in it

a Sales Budget Product JB 50 J860 Anticipated 400000 200000 Unit price 20 25 Total sales 8000000 500... View full answer

Get step-by-step solutions from verified subject matter experts