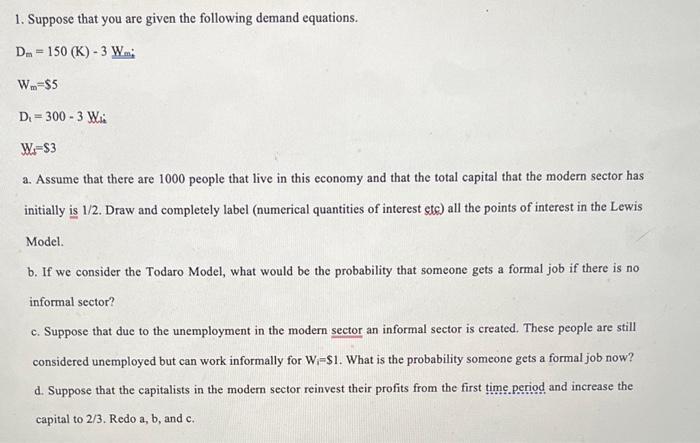

Question: 1. Suppose that you are given the following demand equations. Dm 150 (K)-3 Wm; Wm=$5 D = 300-3 Wi W-$3 a. Assume that there

1. Suppose that you are given the following demand equations. Dm 150 (K)-3 Wm; Wm=$5 D = 300-3 Wi W-$3 a. Assume that there are 1000 people that live in this economy and that the total capital that the modern sector has initially is 1/2. Draw and completely label (numerical quantities of interest etc) all the points of interest in the Lewis Model. b. If we consider the Todaro Model, what would be the probability that someone gets a formal job if there is no informal sector? c. Suppose that due to the unemployment in the modern sector an informal sector is created. These people are still considered unemployed but can work informally for W-$1. What is the probability someone gets a formal job now? d. Suppose that the capitalists in the modern sector reinvest their profits from the first time period and increase the capital to 2/3. Redo a, b, and c.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts