Albers Company acquires an 80% interest in Barker Company on January 1, 2015, for $850,000. The following

Question:

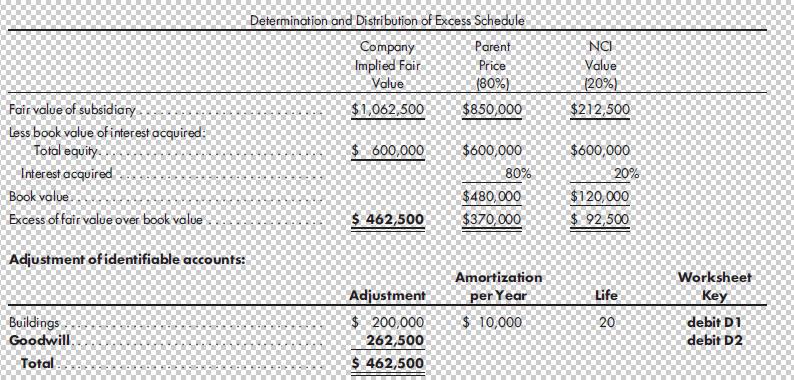

Albers Company acquires an 80% interest in Barker Company on January 1, 2015, for $850,000. The following determination and distribution of excess schedule is prepared at the time of purchase:

Albers uses the simple equity method for its investment in Barker. As of December 31, 2019, Barker has earned $200,000 since it was purchased by Albers. Barker pays no dividends during 2015–2019.

On December 31, 2019, the following values are available:

![]()

Determine if goodwill is impaired. If not, explain your reasoning. If so, calculate the loss on impairment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Question Posted: