Campione Manufacturing acquired an 80% interest in DaLuca Distributors, a foreign corporation established on November 1, 2010,

Question:

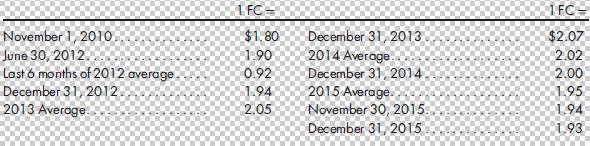

Campione Manufacturing acquired an 80% interest in DaLuca Distributors, a foreign corporation established on November 1, 2010, for 650,000 foreign currency units (FC). Campione acquired its 80% interest on June 30, 2012, when DaLuca’s shareholders’ equity consisted of capital stock, paid-in capital in excess of par, and retained earnings in the amounts of 100,000 FC, 210,000 FC, and 300,000 FC, respectively. The excess of cost over book value was allocated to goodwill and depreciable assets in the amounts of 120,000 FC and 42,000 FC, respectively. The goodwill is annually tested for impairment, and no impairment in the value has been suggested. The depreciable assets are to be depreciated over 10 years assuming the straight-line method. DaLuca’s income and dividends over the period from July 1, 2012, through the end of 2014 were as follows:

The above dividends were declared at year-end.

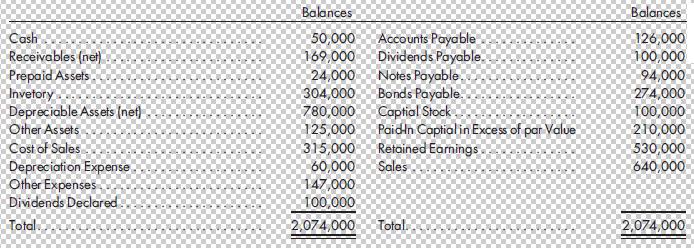

DaLuca’s condensed trial balance in FC as of December 31, 2015, is as follows:

The current-year dividend was declared on November 30, 2015. The FC is DaLuca’s functional currency, and selected exchange rates between the FC and the dollar are as follows:

Required

Prepare the translated trial balance for DaLuca and prepare all of the elimination and adjusting entries necessary to prepare consolidated financial statements. Assume that Campione uses the simple equity method.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng