Company A recorded a profit before tax of $2,500,000 for the year ended 31 December 20x3. The

Question:

Company A recorded a profit before tax of $2,500,000 for the year ended 31 December 20x3. The tax rate for 20x3 was 24% while that of 20x2 was 22%. Deferred tax liability as at 31 December 20x2 was $26,400.

(a) On 1 January 20x1, Company A purchased plant and machinery costing $120,000. The useful life of the plant and machinery was five years, but the capital allowances were to be claimed over a three-year period.

(b) On 1 July 20x2, Company A purchased specialized equipment costing $150,000. The useful life of the equipment was five years from the date of acquisition. However, for tax purposes, capital allowances were claimed in full during 20x2.

(c) Company A completed the development phase of a new drug on 1 January 20x2, which amounted to $50,000.

The expenditures were not deductible for tax purposes but were deemed to have an economic useful life of five years for accounting purposes.

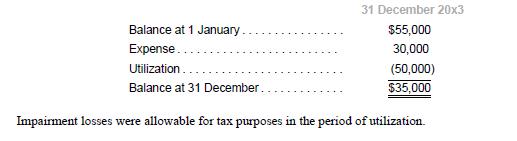

(d) The movement in the provision for impairment losses is as follows:

(e) Dividends received during 20x3 amounted to $50,000 while dividend income for 20x3 was $60,000. Dividends receivable as at 1 January 20x3 were $20,000. Dividend income was taxed when received.

(f) Unearned revenue balance arising from service fees collected in advance as at 31 December 20x3 was $14,000.

Cash received during the year in respect of unearned revenue was $32,000. Earned revenue from service fees for 20x3 was $30,000. Service fees were taxable during the year when the proceeds were received.

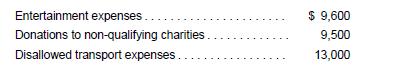

(g) Disallowed items are as follows:

(h) Tax-exempt income and reliefs granted are as follows:

![]()

Required

1. Prepare the tax computation for the year ended 31 December 20x3 based on the above information.

2. Using the balance sheet liability approach, show the cumulative taxable (deductible) temporary differences arising from each asset or liability as at 31 December 20x3.

3. Determine the deferred tax liability as at 31 December 20x3.

4. Perform the analytical check on tax expense for 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah