Harris plc began trading on 1 January 2006, preparing financial statements ended 31 December each year. During

Question:

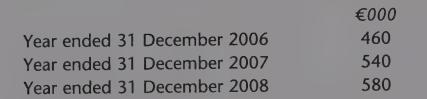

Harris plc began trading on 1 January 2006, preparing financial statements ended 31 December each year. During 2009, the company decided to change its accounting policy with regard to depreciation of property, plant and equipment. Depreciation charges calculated using the previous accounting policy and shown in the company’s financial statements for the first three years of trading were as follows:

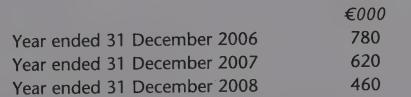

If the new accounting policy had been applied in the previous years, depreciation charges would have been:

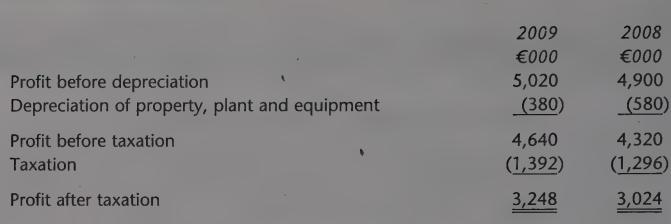

The company’s income statement for the year ended 31 December 2009 (before adjusting comparative figures to reflect the change in accounting policy) shows the following:

Retained earnings were reported as EUR 5,886,000 on 31 December 2007. No dividends have been paid in any year. It may be assumed that the company’s tax expense is each year equal to 30 per cent of the profit before taxation.

(a) Restate the above income ‘statement to reflect the change in accounting policy, in accordance with the requirements of IAS.

(b) Compute the company’s retained earnings at 31 December 2009 and the restated retained earnings at 31 December 2007 and 2008.

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone