Ignore the previous question. On 1 April 20x4, XYZ Company entered into a commitment to sell 10,000

Question:

Ignore the previous question. On 1 April 20x4, XYZ Company entered into a commitment to sell 10,000 units of securities in S Company at a fixed price for delivery on 30 June 20x4. If the call option was deemed as an effective hedge (with time value excluded) of the commitment, which of the following statements is most appropriate under IFRS 9 as at 30 June 20x4?

(a) Profit on sale of securities will increase by $1,300.

(b) Profit on sale of securities will increase by $1,500.

(c) Income from option will increase by $1,300.

(d) Deferred gain in equity will increase by $1,500.

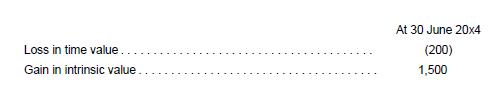

XYZ Company purchased a call option on 1 April 20x4, which was exercised on 30 June 20x4. The changes in time and intrinsic value of the call option to purchase 10,000 units of securities in S Company are as follows:

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah