In 2006 entity X was invited to tender for the construction of a residential block and connected

Question:

In 2006 entity X was invited to tender for the construction of a residential block and connected shopping arcade with common plaza and garden and play areas. Tenders were required to detail the costs of each element separately, but it was clear that only one contractor would win the entire contract due to the interrelated aspect of the development.

In 2006 entity X was invited to tender for the construction of a residential block and connected shopping arcade with common plaza and garden and play areas. Tenders were required to detail the costs of each element separately, but it was clear that only one contractor would win the entire contract due to the interrelated aspect of the development.

During 2007, but before the 2006 anrfual report was issued, entity X was notified that it had been awarded the contract. However, the contract was not signed until after the 2006 annual report was issued.

The contract was for a total of EUR 32m, comprising EUR 18m for the residential Block, EUR 10m for the shopping arcade and EUR 4m for the common plaza, garden and play area. A mobilization advance of EUR 2m was paid at the outset, EUR 2m was payable at the end of 2007, EUR 10m at the end of 2008 and EUR 16m was payable at the end of 2009, at which point the development would be complete and EUR 2m was to be held back as a retention for one year (IAS 11 para 41 defines retentions as amounts of progress billings that are not paid until the satisfaction of conditions specified in the contract for the payment of such amounts or until defects have been rectified).

Entity X initially estimated that the total costs of the project would be EUR 24m, of which EUR 14m would be for the residential block, EUR 8m for the shopping arcade and EUR 2m for the plaza, garden and play area. Included in this cost is EUR 2m of plant acquired specifically for the project that could not be used subsequently. The estimated residual value of this plant at the end of the contract was EUR 200,000. Also included in the overall cost was 30 months of depreciation on general plant and equipment already owned by entity X at EUR 100,000 per month. The on-site accounts staff cost included in the estimate was EUR 10,000 per month. Their role was to maintain and record time cards of workers and receive and issue materials.

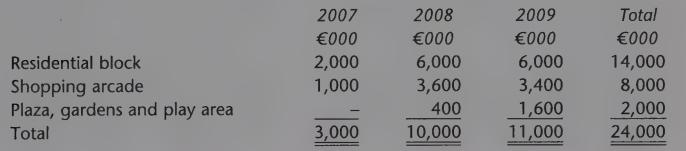

Costs incurred at each year-end were:

The costs at the end of 2007 include EUR 500,000 of materials delivered to the site for use in 2008.

In 2008, EUR 400,000 was paid to sub-contractors in advance for the work to be performed in 2009 on the plaza, gardens and play area.

During 2008 due to a fire at the neighbouring plot, the police cordoned off the whole area for a month while investigations were conducted. During this time all plant and equipment remained idle on site. However, work continued at entity X’s workshop and yard.

During 2008, the customer requested a variation in the contract for EUR 2m; the cost of the variation was estimated at EUR 1.5m. However, the variation was not approved by the customer until after entity X’s 2008 annual report was authorised for issue. Entity X incurred the extra costs for the variation in 2008.

Prepare entity X’s income statement and the amounts that should be presented in the balance sheet for 2006 through 2009.

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone