Mutt and Jeff formed a partnership on April 1 and contributed the following assets: The land was

Question:

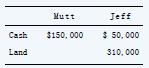

Mutt and Jeff formed a partnership on April 1 and contributed the following assets:

The land was subject to a $30,000 mortgage, which the partnership assumed. Under the partnership agreement, Mutt and Jeff share profit and loss in the ratio of one-third and two-thirds, respectively. Jeff’s capital account at April 1 should be

a. $300,000.

b. $330,000.

c. $340,000.

d. $360,000.

Transcribed Image Text:

Mutt Jeff Cash $150,000 $ 50,000 Land 310,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Question Posted:

Students also viewed these Business questions

-

Select the correct answer for each of the following questions. 1. On May 1, 20X1, Cathy and Mort formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Cathy...

-

Select the best answer for each of the following. 1. Jon and Joe formed a partnership on July 1, 2024, and invested the following assets: The realty was subject to a mortgage of $25,000, which was...

-

How does a project manager calculate start and finish times?

-

The diffraction pattern shown in FIGURE 28-49 is produced by passing He-Ne laser light ( = 632.8 nm) through a single slit and viewing the pattern on a screen 1.50 m behind the slit. (a) What is the...

-

Here's an interesting chal- lenge you can give to a friend. Hold a \$1 (or larger!) bill by an upper corner. Have a friend prepare to pinch a lower corner, putting her fingers near but not touching...

-

The enzyme lipase catalyzes the hydrolysis of esters of fatty acids. The hydrolysis of p-nitrophenyloctanoate was followed by measuring the appearance of p-nitrophenol in the reaction mixture: The...

-

What are the risks and benefits of expanding the Disney brand in new ways?

-

The Operations Manager of Toshiba's laptop manufacturing plant is about to prepare her annual report to the Board of Directors. Using the table below, she outlined the performance of the plant based...

-

On July 1, Mabel and Pierre formed a partnership, agreeing to share profits and losses in the ratio of 4:6, respectively. Mabel contributed a parcel of land that cost her $25,000. Pierre contributed...

-

Two individuals who were previously sole proprietors form a partnership. Property other than cash that is part of the initial investment in the partnership is recorded for financial accounting...

-

Interpret the following symbolized arguments in light of the eight argument forms presented in this section. In some cases a symbolized argument must be rewritten using commutativity or double...

-

You are required to complete the figure in the Workbook for this question. Allocate the accounts into their account group including their sub-classification where necessary. Identify whether the...

-

Using the account names listed and format provided for this question in the Workbook, allocate the accounts into their account group. Identify whether the account is normally debit (dr) or credit...

-

Using the account names listed and format provided for this question in the Workbook, allocate the accounts into their account group. Identify whether the account is normally debit (dr) or credit...

-

At 30 June 2022, R Wallaroi found that the following adjustments needed to be made for the end-of-year accounts. Tax invoices had not yet been processed for the following accounts: advertising $330...

-

Can you find the following 17 basic accounting terms in the find-a-word puzzle? Each word is in a straight line but the line can be in any direction, including diagonal and reverse. Where the word...

-

The refrigerant R-152a, difluoroethane, is tested by the following procedure. A 10-L evacuated tank is connected to a line flowing saturated-vapor R-152a at 40C. The valve is then opened, and...

-

Ex. (17): the vector field F = x i-zj + yz k is defined over the volume of the cuboid given by 0x a,0 y b, 0zc, enclosing the surface S. Evaluate the surface integral ff, F. ds?

-

Assume the same facts as in E8-1 and prepare entries using straight-line amortization of bond discount or premium. In E8-1 Lamar Corporation owns 60 percent of Humbolt Corporations voting shares. On...

-

Assume the same facts as in E8-1 and prepare entries using straight-line amortization of bond discount or premium. In E8-1 Lamar Corporation owns 60 percent of Humbolt Corporations voting shares. On...

-

Assume the same facts as in E8-1 and prepare entries using straight-line amortization of bond discount or premium. In E8-1 Lamar Corporation owns 60 percent of Humbolt Corporations voting shares. On...

-

Developing Criteria. What type of criteria would an advertising agency use in evaluating a campaign to sell soap? A university, in evaluating a new multicultural curriculum? Parents, in evaluating a...

-

Group Roles in Interpersonal Relationships. Can you identify roles that you habitually or frequently serve in certain groups? Do you serve these roles in your friendship, love, and family...

-

Dealing with Organizational Complaints. Assume that youre the leader of a work team consisting of members from each of the major departments in your company. For any one of the complaints listed...

Study smarter with the SolutionInn App