National Computers (NC) and Hightech Ltd. (HT), two unrelated companies, agreed to share the latest technology in

Question:

On January 1, 20X5, NC and HT incorporated a new company, Voice Ltd. (VL). Two classes of VL common shares were issued. Each share in both classes participates equally in the company€™s earnings. Class A shares are non-voting, whereas Class B shares are voting. In return for 59 Class A shares and 1 Class B share, NC contributed land with a fair market value of $1,600,000 (NC€™s carrying value for the land was $800,000). In return for 39 Class A shares and 1 Class B share, HT contributed cash of $1,000,000.

Of the five-member board of directors of VL, three are nominees of NC and two are nominees of HT. Initially, it was decided that VL would conserve its cash by paying no dividends. Under a written agreement, any change in the dividend policy of VL, and any transactions between VL and either NC or HT, must be approved in advance by both NC and HT. NC has retained the right to select VL€™s chief executive officer. The primary activity of NC is the manufacturing of personal computers.

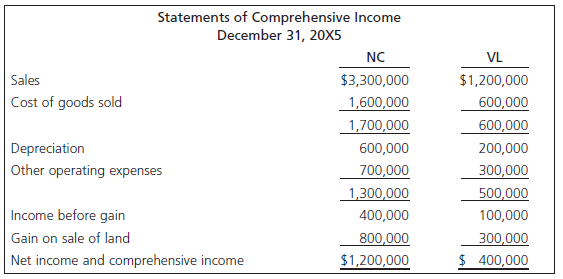

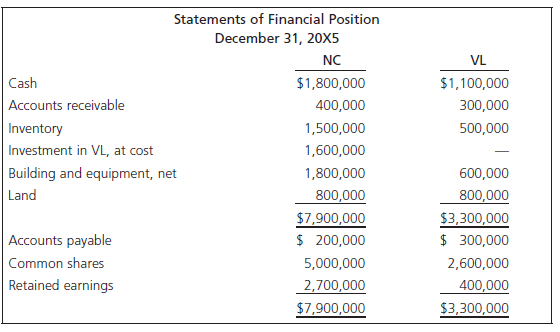

Extracts from the statements of comprehensive income and the statements of financial position for NC and VL are as follows, ignoring the impact of income taxes:

Additional Information

1. During 20X5, VL sold one-half of the land transferred from NC for proceeds of $1,100,000 and recorded a gain of $300,000.

2. A management fee of $150,000, paid to NC by VL during 20X5, is included in other operating expenses of VL and sales of NC in the above 20X5 statements of comprehensive income.

3. VL€™s ending inventory includes goods purchased from NC for $400,000. NC€™s cost for these goods was $275,000. NC€™s ending inventory includes goods purchased from VL for $250,000. VL€™s cost for these goods was $150,000.

Required

The following are four possible alternatives for accounting for NC€™s investment in VL:

a. cost;

b. equity;

c. proportionate consolidation; and

d. consolidation.

Discuss the appropriateness of using each of these four alternatives.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay