On 1 January 20x1, ACE Corporation introduced a share appreciation rights (SARs) plan for 20 selected senior

Question:

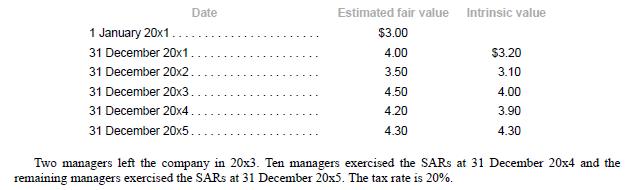

On 1 January 20x1, ACE Corporation introduced a share appreciation rights (SARs) plan for 20 selected senior managers. Under the plan, each manager was granted 10,000 share appreciation rights, which vested on 31 December 20x3. The managers must remain in ACE Corporation’s employment during the vesting period. The SARs were exercisable from 1 January 20x4 to 31 December 20x5. At exercise date, if the share price of ACE Corporation had appreciated, each grantee would receive cash equal to the amount of increase in the share price multiplied by 10,000 rights. The management of ACE Corporation estimated the forfeiture rate at 5%. This estimated forfeiture rate was maintained throughout the vesting period. The following information is available on the fair value and intrinsic value of the SARs:

Required

1. Calculate the remuneration expense for the years 20x1 to 20x5.

2. Prepare journal entries relating to the share appreciation rights plan for the period 20x1 to 20x5.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah