On 1 July 20x1, Carmen Corporation purchased two bonds, Bond A and Bond B, whose issuers had

Question:

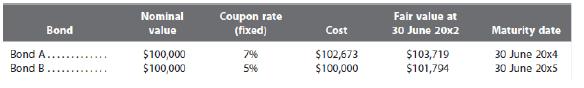

On 1 July 20x1, Carmen Corporation purchased two bonds, Bond A and Bond B, whose issuers had different credit ratings. At the date of purchase, the effective interest rate for Bond A was 6% and the effective interest rate for Bond B was 5%.

Additional information

(a) Interest payments were paid by the issuers annually on 30 June each year.

(b) The fair values of the two bonds on 30 June 20x2 reflected an effective interest rate of 5% for Bond A and 4.5% for Bond B.

(c) At the date of purchase of the bonds Carmen classified both bonds as amortized cost as the business model is to hold the bond to collect contractual cash flows.

(d) Carmen Corporation’s financial year-end is 30 June.

Required

Assume that on 30 June 20x2, Carmen sold off Bond A as it urgently needed the funds to meet an unexpected contingency. Assume that the credit ratings of both bonds remained unchanged. Show the journal entries from 1 July 20x1 to 30 June 20x2.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah