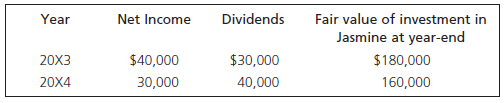

On January 1, 20X3, Rose Corporation purchased 25% of the outstanding shares of Jasmine Corporation at a

Question:

Required

What income/gains and losses will Rose report from its investment in Jasmine in its net income from continuing operations and other comprehensive income for 20X3 and 20X4 respectively, and what would the balance be in the Jasmine account at the end of fiscal year 20X4, assuming that the investment is recorded and reported:

a. Under the cost method?

b. As a FVTPL investment?

c. As a FVTOCI investment?

d. Under the equity method?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: