On January 1, 20X4, Plum Corporation acquired Silva Company, a Brazilian subsidiary, by purchasing all its common

Question:

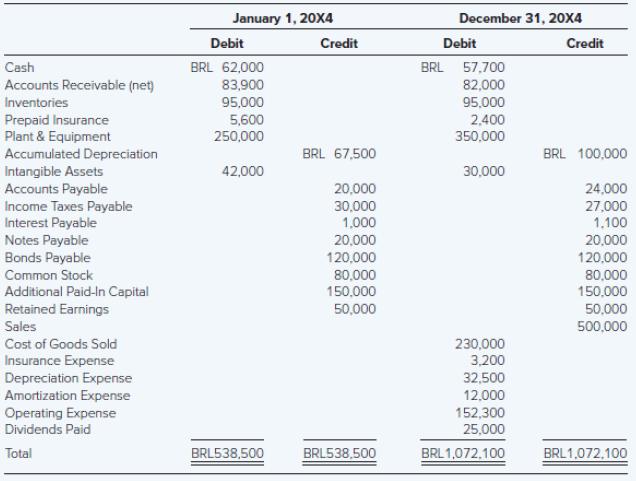

On January 1, 20X4, Plum Corporation acquired Silva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. Silva’s trial balances on January 1, 20X4, and December 31, 20X4, expressed in Brazilian reals (BRL), follow:

Additional Information

1. Silva uses FIFO inventory valuation. Purchases were made uniformly during 20X4. Ending inventory for 20X4 is composed of units purchased when the exchange rate was $0.25.

2. The insurance premium for a two-year policy was paid on October 1, 20X3.

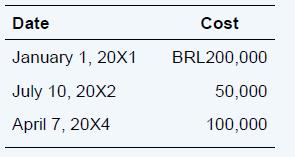

3. Plant and equipment were acquired as follows:

4. Plant and equipment are depreciated using the straight-line method and a 10-year life, with no residual value. A full month’s depreciation is taken in the month of acquisition.

5. The intangible assets are patents acquired on July 10, 20X2, at a cost of BRL60,000. The estimated life is five years.

6. The common stock was issued on January 1, 20X1.

7. Dividends of BRL10,000 were declared and paid on April 7. On October 9, BRL15,000 of dividends were declared and paid.

8. Exchange rates were as follows:

Required

a. Prepare a schedule translating the December 31, 20X4, trial balance of Silva from reals to dollars assuming the real is the functional currency.

b. Prepare a schedule calculating the translation adjustment as of the end of 20X4. The net assets on January 1, 20X4, were BRL280,000.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd