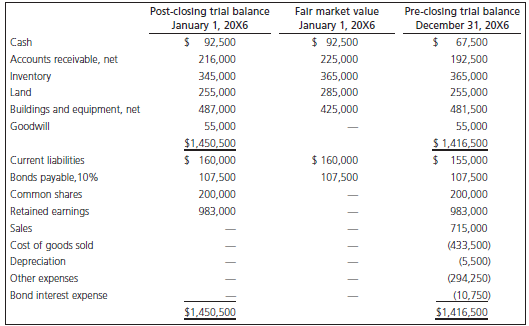

On January 1, 20X6, Parent Ltd. purchased 100% of the outstanding voting common shares of Sub Ltd.

Question:

During 20X6, the following events occurred:

1. Neither Parent nor Sub paid any dividends.

2. Sub Ltd. sold inventory costing $247,000 to Parent Ltd. for $341,000, 30% of which was not sold at year-end.

3. All of the current assets of Sub at the time of acquisition were sold to outside parties or were collected.

4. Parent Ltd. uses the cost method to record the investment in Sub. Condensed trial balance information for Sub Ltd. and Parent Ltd. is shown below.

Required

Prepare a consolidated statement of comprehensive income and retained earnings and a consolidated statement of financial position for Parent Ltd. for the year ended December 31, 20X6.

Parent Ltd. Pre-closing Trial Balance December 31, 20X6

Cash..............................................................................$ 137,500

Accounts receivable, net...............................................192,000

Marketable securities......................................................64,500

Inventory........................................................................430,000

Land................................................................................365,000

Buildings and equipment, net.....................................431,000

Goodwill*.........................................................................70,000

Investment in Sub Ltd...............................................1,400,000

..................................................................................$ 3,090,000

Current liabilities.......................................................$ 197,500

Bonds payable..............................................................342,500

Common shares...........................................................550,000

Retained earnings.....................................................1,878,500

Sales...............................................................................965,000

Cost of goods sold.....................................................(731,500)

Depreciation.................................................................(13,500)

Other expenses..........................................................(101,725)

Bond interest income......................................................3,225

.................................................................................$ 3,090,000

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay