On January 2, 20X5, Playful Inc. purchased 60% of the outstanding common shares of Serious Ltd. for

Question:

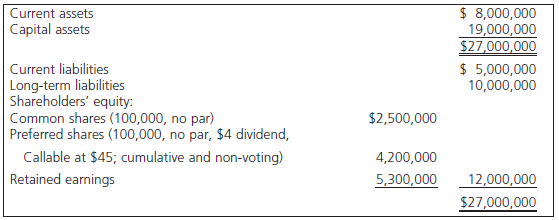

Serious€™s condensed statement of financial position at that time was as follows:

The fair value of Serious€™s assets was the same as their carrying value except for capital assets, which had a fair value of $22,000,000. The capital assets have a remaining useful life of 15 years. Goodwill on the purchase is tested for impairment on an annual basis.

On October 1, 20X5, Playful purchased 20,000 of Serious€™s preferred shares at $35 per share. There were no dividend arrearages. Serious declared the fourth-quarter preferred dividend on December 15, 20X5, payable on January 15, 20X6, to holders of record on December 30, 20X5.

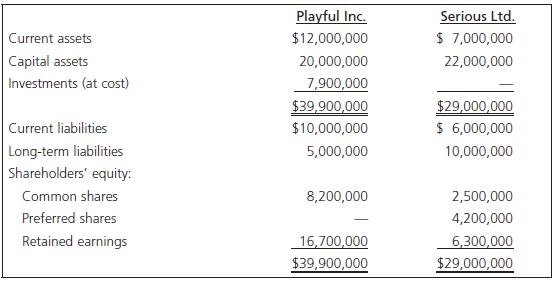

The condensed statements of financial position for both Playful and Serious were as follows on December 31, 20X5:

Required

Prepare a consolidated statement of financial position for Playful Inc. at December 31, 20X5.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay