Question: On November 7, 20X5, Labrador Limited signed a contract to buy equipment from a US manufacturer. The equipment was to be delivered on January 15

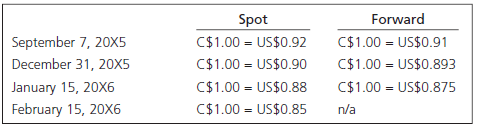

Labrador designated the forward contract as a hedge of the outstanding purchase commitment on the equipment. The equipment is delivered on January 15, 20X6. The exchange rates are:

Labrador paid the manufacturer and closed out the forward contract on February 15, 20X6.

Required

1. Assume the hedge was designated as a fair-value hedge. Record the journal entries to record the purchase and the related hedge for 20X5 and 20X6. Labrador€™s fiscal year ends on December 31. Ignore amortization of the equipment.

2. Assume the hedge was designated as a cash-flow hedge. Record the journal entries to record the purchase and the related hedge for 20X5 and 20X6. Labrador€™s fiscal year ends on December 31. Ignore amortization of the equipment.

Forward C$1.00 = US$0.91 C$1.00 = US$0.893 C$1.00 = US$0.875 Spot C$1.00 = US$0.92 C$1.00 = US$0.90 C$1.00 = US$0.88 C$1.00 = US$0.85 September 7, 20X5 December 31, 20X5 January 15, 20X6 February 15, 20X6 %3D n/a

Step by Step Solution

3.58 Rating (169 Votes )

There are 3 Steps involved in it

The hedge is treated as first a fairvalue hedge and second a cashflow hedge Suggested solutions are given below 1 Fairvalue hedge Gross Method Net Method September 7 20X5 Deposit on equipment 100000 0... View full answer

Get step-by-step solutions from verified subject matter experts