P Co acquired control of Sapphire Co on 1 July 20x8 by acquiring 90% of the ordinary

Question:

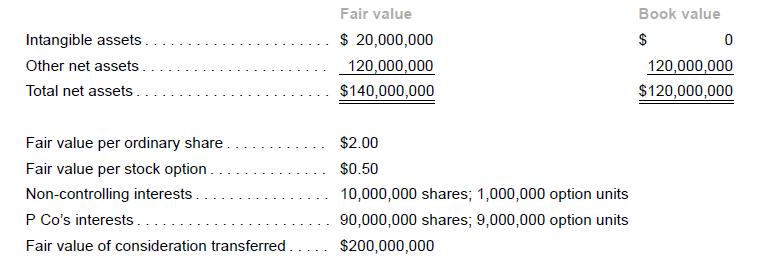

P Co acquired control of Sapphire Co on 1 July 20x8 by acquiring 90% of the ordinary shares and stock options of Sapphire Co through paying cash of $200,000,000 to the former owners of Sapphire Co. P Co measures noncontrolling interests at fair value. Tax on fair value of identifiable net assets should be recognized at 20%. The information on identifiable net assets of Sapphire Co is shown below:

Required:

1. Determine the amount of non-controlling interests that has to be recognized by P Co as at acquisition date.

2. Determine the amount of goodwill that has to be recognized by P Co as at acquisition date.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah

Question Posted: