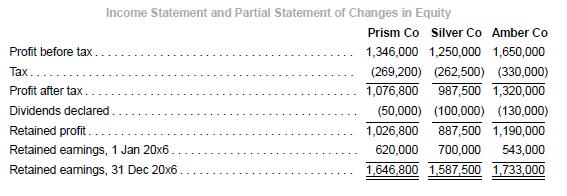

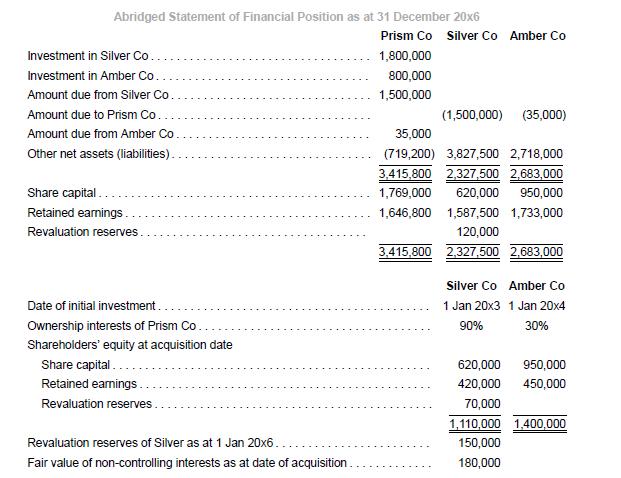

P Co acquired interests in Silver Co and Amber Co. Their current financial statements are shown below.

Question:

P Co acquired interests in Silver Co and Amber Co. Their current financial statements are shown below. All figures are in $ unless as otherwise indicated.

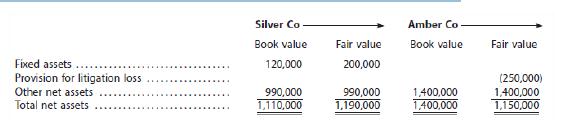

Fair and book values of identifiable net assets of each company as at date of acquisition:

Additional information

(a) Remaining useful life of undervalued fixed assets of Silver Co as at 1 January 20x3 was 20 years. Residual value was negligible.

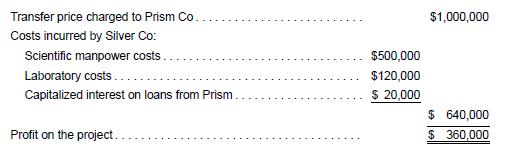

(b) On 31 December 20x4, Silver Co completed a development project for Prism Co to develop a new vaccine.

The two-year development project was successful and the useful life of the vaccine as at 1 January 20x5 was 10 years. Silver Co recognized profit on the project as follows:

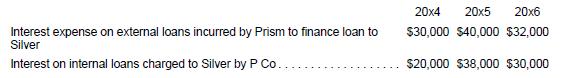

(c) Prism Co finances the development and operations of Silver Co by borrowing from external banks and lending to Silver Co. Interest on external loans to finance the loan from Prism to Silver Co for the development project in (2) above was $30,000 in 20x4 (see table below). After the completion of the development project, Prism Co continues to lend to Silver Co to finance its operations in 20x5 and 20x6.

(d) Amber Co expensed the following amounts relating to the litigation loss:

![]()

No further losses were expected after 20x6.

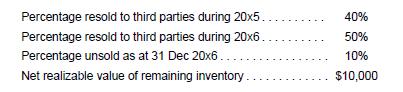

(e) Amber Co sold excess inventory to Prism Co during 20x5 at transfer price of $120,000 when the carrying amount was $80,000. Subsequently:

(f) Assume a tax rate of 20%.

(g) Non-controlling interests are measured at full fair value at acquisition date.

Required

1. Prepare consolidation adjusting entries for the year ended 31 December 20x6, with narratives (brief headers) in accordance with IFRS 3 and IFRS 10.

2. Prepare equity accounting entries for the year ended 31 December 20x6, with narratives (brief headers) in accordance with IAS 28.

3. Perform an analytical check on the balance of non-controlling interests as at 31 December 20x6.

4. Perform an analytical check on the balance of the investment in associate account as at 31 December 20x6.

5. Perform an analytical check on the consolidated retained earnings as at 31 December 20x6.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah