Paper Corporation acquired 75 percent of Script Companys common stock on May 15, 20X3, at underlying book

Question:

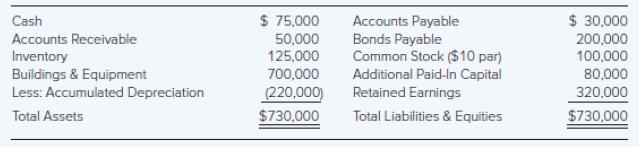

Paper Corporation acquired 75 percent of Script Company’s common stock on May 15, 20X3, at underlying book value. Script’s balance sheet on December 31, 20X6, contained these amounts:

During 20X7, Paper earned operating income of $90,000, and Script reported net income of $45,000. Neither company declared any dividends during 20X7. Assume Paper Corporation has only no-par stock outstanding.

Script is considering repurchasing 1,000 of its outstanding shares as treasury stock for $68 each.

Required

a. Assuming Script purchases the shares from Nonaffiliated Company on January 1, 20X7:

(1) Compute the effect on the book value of the shares held by Paper.

(2) Give the entry on Paper’s books to record the change in the book value of its investment in Script’s shares.

(3) Prepare the consolidation entries needed on December 31, 20X7, to complete a worksheet.

b. Assuming Script purchases the shares directly from Paper on January 1, 20X7:

(1) Compute the effect on the book value of the shares held by Paper.

(2) Give the entry on Paper’s books to record its sale of Script shares to Script.

(3) Prepare the consolidation entries needed on December 31, 20X7, to complete a worksheet.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd