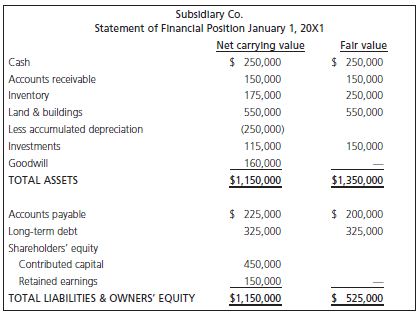

Parent Corp. purchased 100% of the outstanding shares of Subsidiary Corp. on January 1, 20X1, for $1,000,000.

Question:

The buildings are being depreciated using straight-line depreciation and had a future life of five years on the date of acquisition. All current assets and liabilities turned over by the end of 20X1.

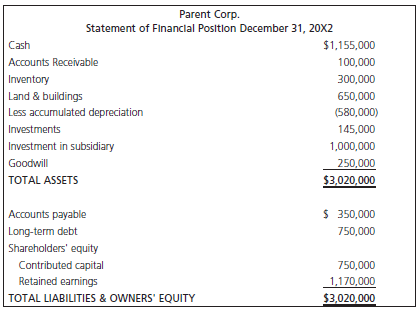

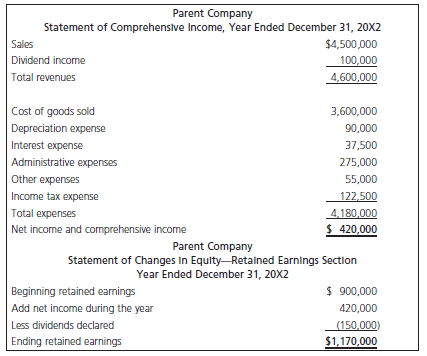

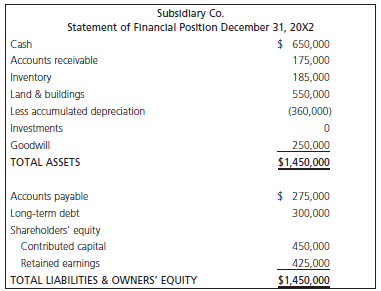

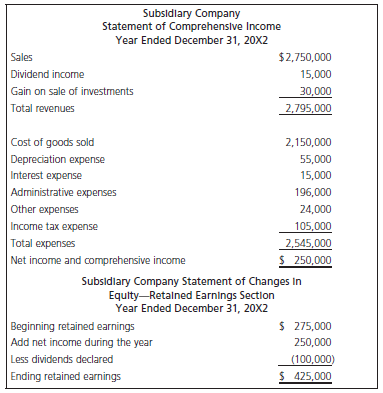

The separate-entity financial statements of Parent Corp. and Subsidiary Corp. for 20X2 are provided below.

Additional information:

– Subsidiary Corp. sold goods worth $300,000 at a gross profit of 25% to Parent Corp. in 20X0 (the year before 20X1). All of these goods remained unsold in Parent Corp.€™s ending inventory at the end of year 20X0. Half of these goods were sold in 20X1, and the remaining half was sold in 20X2 to outsiders by Parent Corp.

– Subsidiary Corp. sold goods worth $250,000 at a gross profit of 30% to Parent Corp. in 20X1. One-third of these goods remained unsold with Parent Corp. at the end of 20X1. Parent Corp. sold goods worth $300,000 at a gross profit of 25% to Subsidiary Corp. in 20X1. Half of these goods remained unsold with Subsidiary Corp. at the end of 20X1.

– Subsidiary Corp. sold goods worth $200,000 at a gross profit of 30% to Parent Corp. in 20X2. Half of these goods remained unsold with Parent Corp. at the end of 20X2. Parent Corp. sold goods worth $350,000 at a gross profit of 25% to Subsidiary Corp. in 20X2. Forty percent of these goods remained unsold with Subsidiary Corp. at the end of 20X2.

– Subsidiary Corp. sold all of its investments in 20X2 to Parent Corp. for $145,000.

Required

a. Show the purchase price allocation calculations required at the time of acquisition and the goodwill balance at the time of acquisition.

b. Show all necessary consolidation adjustments required in 20X2 relating to 20X1 and 20X2 (i.e., show the remaining adjustments other than the acquisition-related adjustments required in item a, necessary under the MEAR steps).

c. Calculate the consolidated retained earnings balance at the end of 20X1.

d. Calculate the adjusted income of Subsidiary Corp. and the adjusted income of Parent Corp. for 20X2.

e. Calculate the consolidated income in 20X2.

f. Calculate the consolidated retained earnings balance at the end of 20X2.

g. Calculate the consolidated gross (i.e., original cost) and net balance (i.e., after deductin accumulated depreciation) of the buildings account at the end of 20X2.

h. Calculate the consolidated goodwill balance at the end of 20X2.

i. Calculate the consolidated investment account balance at the end of 20X2.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay