Part A. Garman International wants to expand its operations and decides to acquire the net assets of

Question:

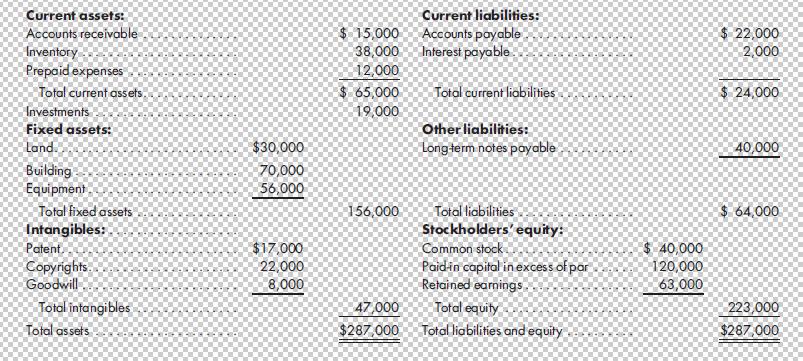

Part A. Garman International wants to expand its operations and decides to acquire the net assets of Iris Company as of January 1, 2016. Garman issues 10,000 shares of its $5 par value common stock for the net assets of Iris. Garman’s stock is selling for $27 per share. In addition, Garman pays $10,000 in acquisition costs. A balance sheet for Iris Company as of December 31, 2015, is as follows:

In reviewing Iris’s balance sheet and in consulting with various appraisers, Garman has determined that the inventory is understated by $2,000, the land is understated by $10,000, the building is understated by $15,000, and the copyrights are understated by $4,000. Garman has also determined that the equipment is overstated by $6,000, and the patent is overstated by $5,000.

The investments have a fair value of $33,000 on December 31, 2015, and the amount of goodwill (if any) must be determined.

Required

Part A1. Using the information above, do value analysis, and record the acquisition of Iris Company on Garman International’s books on January 1, 2016.

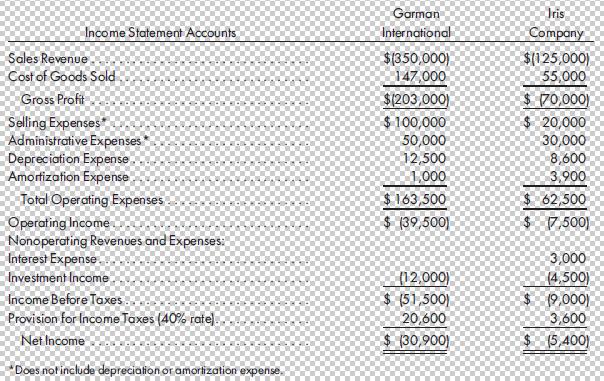

Part A2. Garman International wishes to estimate its pro forma disclosure of operations for 2016 resulting from acquisition of Iris. Pro forma disclosure includes revenue and net income. Projected income statements for 2016 are as follows:

Garman International estimates that the following amount of depreciation and amortization should be taken on the revalued assets of Iris Company:

Required

Part B1. Using the above information, prepare a pro forma income statement for Garman International combined with Iris Company for the year ended December 31, 2016. Schedule your calculations for revenue and net income.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng