Platinum Corporation acquired 10,500 shares of the common stock and 800 shares of the 8 percent preferred

Question:

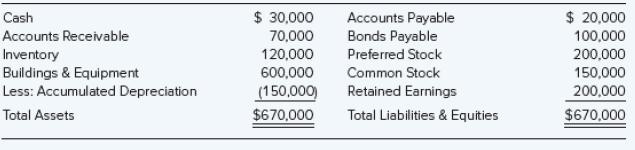

Platinum Corporation acquired 10,500 shares of the common stock and 800 shares of the 8 percent preferred stock of Silver Company on December 31, 20X4, at the book value of the underlying stock interests. At that date, the fair value of the noncontrolling interest in Silver’s common stock was equal to 30 percent of the book value of its common stock interest. Silver reported the following balance sheet amounts on January 1, 20X5:

Silver’s preferred stock is $100 par value, and its common stock is $10 par value. The preferred dividends are cumulative and are two years in arrears on January 1, 20X5. Silver reports net income of $34,000 for 20X5 and pays no dividends.

Required

a. Present the worksheet consolidation entries needed to prepare a consolidated balance sheet on January 1, 20X5.

b. Assuming that Platinum reported income from its separate operations of $80,000 in 20X5, compute the amount of consolidated net income and the amount of income to be assigned to the controlling shareholders in the 20X5 consolidated income statement.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd