Power Corporation acquired 100 percent of Strip Corporation in a nontaxable transaction. The following selected information is

Question:

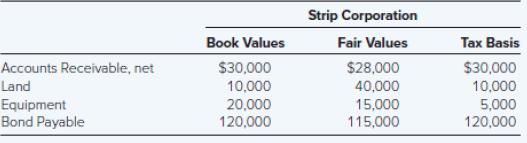

Power Corporation acquired 100 percent of Strip Corporation in a nontaxable transaction. The following selected information is available for Strip Corporation at the acquisition date:

Strip Corporation has never recorded an allowance for doubtful accounts; however, upon review of the accounts receivable detail, Power has determined that approximately $2,000 of the receivables are uncollectible.

Several years ago, Strip purchased a small plot of land for an expanded parking area that has never been developed. An outside party has recently offered to purchase the land for $40,000. Power estimated the value of the equipment acquired with Strip to be $15,000.

Strip issued $120,000 in bonds (at par) two years ago. Since that time, interest rates have changed, which has been reflected in the fair value of those bonds at the date of acquisition. The current and future tax rate for Power Strip Consolidated is 40 percent.

Required

Compute the amounts to be included in the consolidated balance sheet as deferred tax asset, net, or deferred tax liability, net, resulting from the Strip acquisition.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd