Refer to the preceding information for Fast Cools acquisition of Fast Airs common stock. Assume Fast Cool

Question:

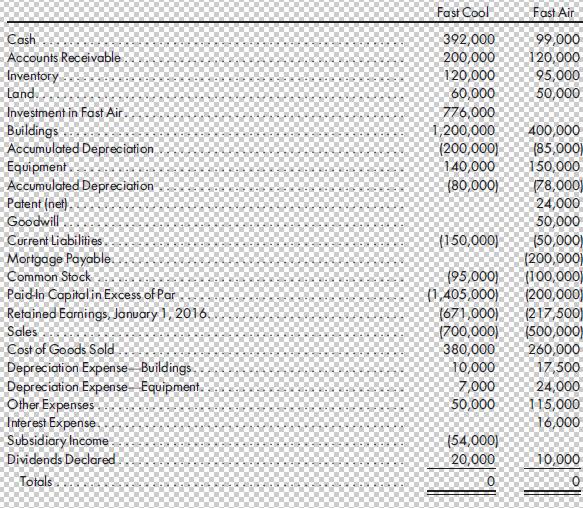

Refer to the preceding information for Fast Cool’s acquisition of Fast Air’s common stock. Assume Fast Cool issues 35,000 shares of its $20 fair value common stock for 80% of Fast Air’s common stock. Fast Cool uses the simple equity method to account for its investment in Fast Air. Fast Cool and Fast Air have the following trial balances on December 31, 2016:

Required

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Fast Air.

2. Complete a consolidated worksheet for Fast Cool Company and its subsidiary Fast Air Company as of December 31, 2016. Prepare supporting amortization and income distribution schedules.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng