Question: Richardson Corporation was created to develop computer software. On January 1, 20X3. Wealthy Company acquired 90 percent of the common stock of Richardson Corporation in

Richardson Corporation was created to develop computer software. On January 1, 20X3. Wealthy Company acquired 90 percent of the common stock of Richardson Corporation in a business combination recorded as a pooling of interests. Wealthy Company continued to operate Richardson Corporation as a separate legal entity and used the basic equity method in accounting for its investment.

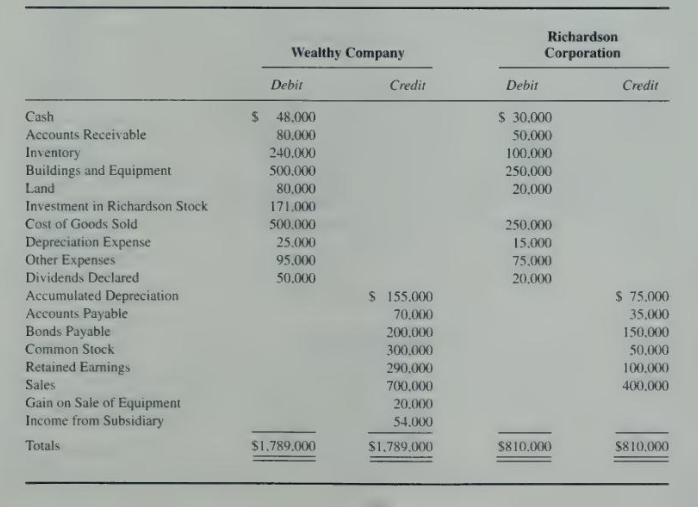

Trial balances for Wealthy Company and Richardson Corporation on December 31, 20X3, are as follows:

During 20X3, Richardson Corporation purchased inventory costing \(\$ 20,000\) and sold it to Wealthy Company for \(\$ 30.000\). Wealthy Company resold 60 percent of the inventory in \(20 \times 3\).

On January 2. 20X3. Wealthy Company sold equipment to Richardson Corporation for \(\$ 120,000\). The equipment had been purchased for \(\$ 150,000\) five years earlier by Wealthy Company and was depreciated on a straight-line basis with an expected life of 15 years. Richardson Corporation is depreciating the equipment over an expected 10 -year life on a straight-line basis. with no expected residual value.

\section*{Required}

a. Prepare a three-part consolidation workpaper in good form as of December 31, 20X3.

b. Prepare a consolidated income statement, balance sheet, and statement of changes in retained earnings for \(20 \mathrm{X} 3\).

Wealthy Company Richardson Corporation Debit Credit Debit Credit Cash $ 48.000 $ 30,000 Accounts Receivable 80.000 50.000 Inventory 240.000 Buildings and Equipment 500.000 100.000 250,000 Land 80.000 20,000 Investment in Richardson Stock 171.000 Cost of Goods Sold 500.000 250.000 Depreciation Expense 25.000 15.000 Other Expenses 95.000 75,000 Dividends Declared 50.000 20,000 Accumulated Depreciation Accounts Payable $ 155.000 70.000 $ 75.000 35,000 Bonds Payable 200.000 150,000 Common Stock 300.000 50,000 Sales Retained Earnings Gain on Sale of Equipment Income from Subsidiary Totals 290.000 100.000 700,000 400.000 20.000 54.000 $1.789.000 $1,789,000 $810,000 $810,000

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts