Shames Company is located in London, England. The local currency is the British pound (). On January

Question:

Shames Company is located in London, England. The local currency is the British pound (£). On January 1, 20X8, Pit Company purchased an 80 percent interest in Shames for $400,000, which resulted in an excess of cost-over-book value of $48,000 due solely to a trademark having a remaining life of 10 years. Pit uses the equity method to account for its investment.

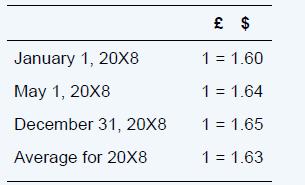

Shames’s December 31, 20X8, trial balance has been translated into U.S. dollars, requiring a translation adjustment debit of $6,400. Shames’s net income translated into U.S. dollars is $60,000. It declared and paid a £15,000 dividend on May 1, 20X8.

Relevant exchange rates are as follows:

Required

a. Record the dividend received by Pit from Shames.

b. Prepare the entries to record Pit’s equity in the net income of Shames and the parent’s share of the translation adjustment.

c. Show a calculation of the differential reported on the consolidated balance sheet of December 31, 20X8, and the translation adjustment from differential.

d. Record the amortization of the trademark on Pit’s books.

e. Calculate the amount of the translation adjustment reported on the statement of comprehensive income as an element of other comprehensive income.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd