The following information pertains to First Corporation Ltd: (a) The number of ordinary shares outstanding at the

Question:

The following information pertains to First Corporation Ltd:

(a) The number of ordinary shares outstanding at the beginning of 20x1 was 30,000,000.

(b) On 1 April 20x0, 6,000,000 convertible preference shares were issued for assets in a purchase transaction. The net-of-tax quarterly dividend on each convertible preference share was $0.04, payable at the end of each quarter. Each share was convertible into one ordinary share. Holders of 5,000,000 convertible preference shares converted their preference shares into ordinary shares on 1 July 20x1.

(c) Warrants to buy 5,000,000 ordinary shares at $4 per share for a period of five years were issued on 1 January 20x1. 50% of the outstanding warrants were exercised on 1 October 20x1.

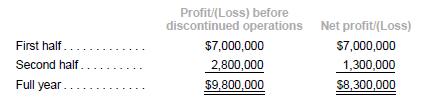

(d) Information on net profit (loss) before dividends is as follows:

(e) The average market prices of First Corporation’s ordinary shares for the calendar-year 20x1 were as follows:

(f) The average market price from 1 July 20x1 to 1 October 20x1 was $4.70 while that for the period from 1 January 20x1 to 1 October 20x1 was $4.50.

Required

Calculate the basic and diluted earnings per share for each interim period and for the full-year ended 31 December 20x1.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah