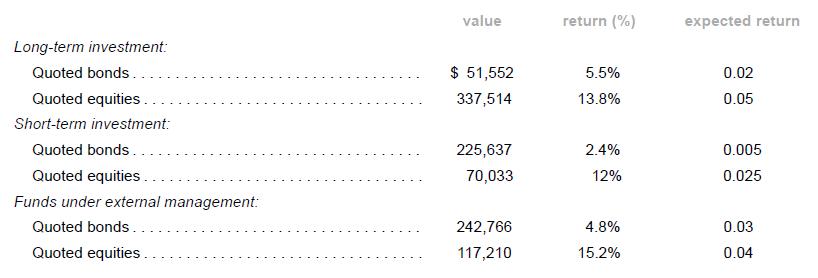

The following table shows the investments of SP Ltd, which are classified into three sub-categories. Assumptions: (a)

Question:

The following table shows the investments of SP Ltd, which are classified into three sub-categories.

Assumptions:

(a) Returns are independently and normally distributed.

(b) Each category is treated as a two-asset portfolio.

(c) Time horizon is as follows: Long-term investment: one-year Short-term investment: one-month Managed funds: six months

Required:

1. Calculate the VaR for each category at 95% and 99% confidence levels assuming that the covariance of the returns is zero.

2. Ignore (1). The covariance of the portfolios are as follows: Short-term investments: 0.01 Long-term investments: 0.02 Managed funds: 0.03 Calculate the VaR for each category at 95% and 99% confidence levels. Compare your answers with those in (1). What conclusion can you draw? (Adjust annual returns proportionately for time horizons of less than a year, e.g., monthly return is assumed to be 1/12 of annual return.)

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah