Thompson Technology, Inc., and Beaudoin Catering Corporation are asking you to recommend their stock to your clients.

Question:

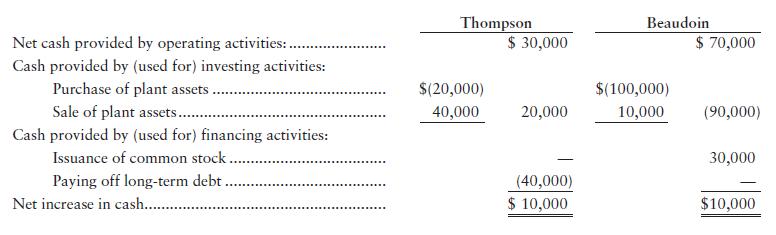

Thompson Technology, Inc., and Beaudoin Catering Corporation are asking you to recommend their stock to your clients. Because Thompson and Beaudoin earn about the same net income and have similar financial positions, your decision depends on their statements of cash flows, which are summarized as follows:

Requirement

Based on their cash flows, which company looks better? Give your reasons.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: