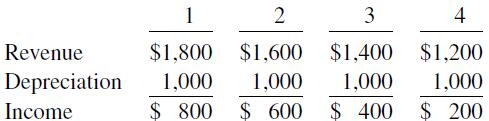

Assume an investment of $4,000 has the following projected income statements. There are zero taxes. The cost

Question:

Assume an investment of $4,000 has the following projected income statements. There are zero taxes. The cost of equity is 0.10.

a. Compute the NPV using the cash flows.

b. Compute the economic incomes of each year (subtract an interest cost on the capital used).

Compute the NPV using economic income.

Compute the investment’s internal rate of return.

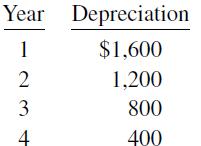

c. Now assume the depreciation schedule is:

Compute the economic incomes of each year and the NPV using economic income.

d. What is the present value depreciation of each year if 0.10 is used as the discount rate and $4,830 is used as the depreciation base?

e. Using the answer to (d), compute the incomes and ROE of each year.

f. What is the present value depreciation of each year if 0.20 is used as the discount rate and $4,000 is used as the depreciation base?

g. Using the answer to (f), compute the income and ROE of each year.

h. (continue a) Instead of an investment of $4,000, assume the book value is $9,000 and the terminal value at time 4 is $1,756.92.

Compute the NPV using the cash flows.

Compute the economic incomes of each year.

Compute the NPV using economic incomes and other relevant information.

Step by Step Answer:

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman